The ascent of the cryptocurrency and the power to place the pools in trading etc

In recent years, the world of cryptocurrency has undergone a significant increase in popularity, with many investors who flock to explore new opportunities and coverage against market volatility. Among the various cryptocurrencies, Ethereum Classic (etc) has attracted significant attention, in particular for its strong foundations and the potential for long -term growth. A key strategy that has contributed to the success of ETC is the role of the placement of pool in the trading of the cryptocurrency.

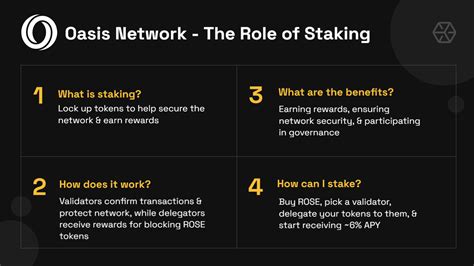

What are swimming pools?

The strokes are platforms that allow users to group the calculation power with others to ensure a blockchain network and earn prizes in exchange. In the case of Ethereum Classic, the swimming pools allow traders to participate in the network validation process etc, ensuring the blockchain and earning new tokens.

The importance of hitting swimming pools for trading etc

For traders involved in trading, etc., points offer several advantages that can help increase their successful possibilities. Here are some reasons why:

- Increase in safety : repairing resources with others, traders reduce the risk of failure of individual nodes or hacking attacks on the classic Ethereum network.

- lower transaction commissions : with multiple nodes participating in validation, transaction commissions per etc can be significantly reduced, making it more accessible to a wider trader range.

3

- Potential for higher prizes : By joining the stamps, traders can participate in the validation process and earn new token in exchange, which can be used for purchase etc. Or other cryptocurrencies.

How the location pools work

The placement pools generally operate by aggregating a group of users with different computational resources (e.g. CPU, GPU or RTT) to participate in the validation process. Each user contributes to the processing power and the skills to the pool, which is therefore combined in a single entity that protects the network.

Types of Picected Pools

There are two main types of pickets of pickets: those that use the algorithm of Pow-Of-Stake consent (POS) and those who use the delegated test (DPO) or EquaHash (Equipos). Each type has its benefits and disadvantages, which the traders should consider carefully before participating in a pool of shots.

Cryptocurrency market trends

In recent months, the cryptocurrency market has undergone significant fluctuations due to various factors, including:

- MARKET Volatility : Over -course volatility of the main cryptocurrencies such as Bitcoin (BTC) Ed Ethereum (ETH) can create opportunities for traders involved in trading etc.

2

- The adoption of new technologies : the development and adoption of new technologies such as quantum calculation and decentralized finance solutions (Defi) can create opportunities for operators involved in the pools of pickets.

Conclusion

In conclusion, the swimming pools play a crucial role in the success of the Ethereum Classic trade (etc.). Meeting resources with others to guarantee the network, traders reduce the risk, improve efficiency and potentially earn higher rewards. While the cryptocurrency market continues to evolve, the traders should be aware of the benefits and potential disadvantages of the location pools and carefully consider their investment strategies.

Advice

If you are interested in trading etc. Or participate in a swimming pool, here are some tips:

1.

Cart is empty

Cart is empty

Leave A Comment